Why Now

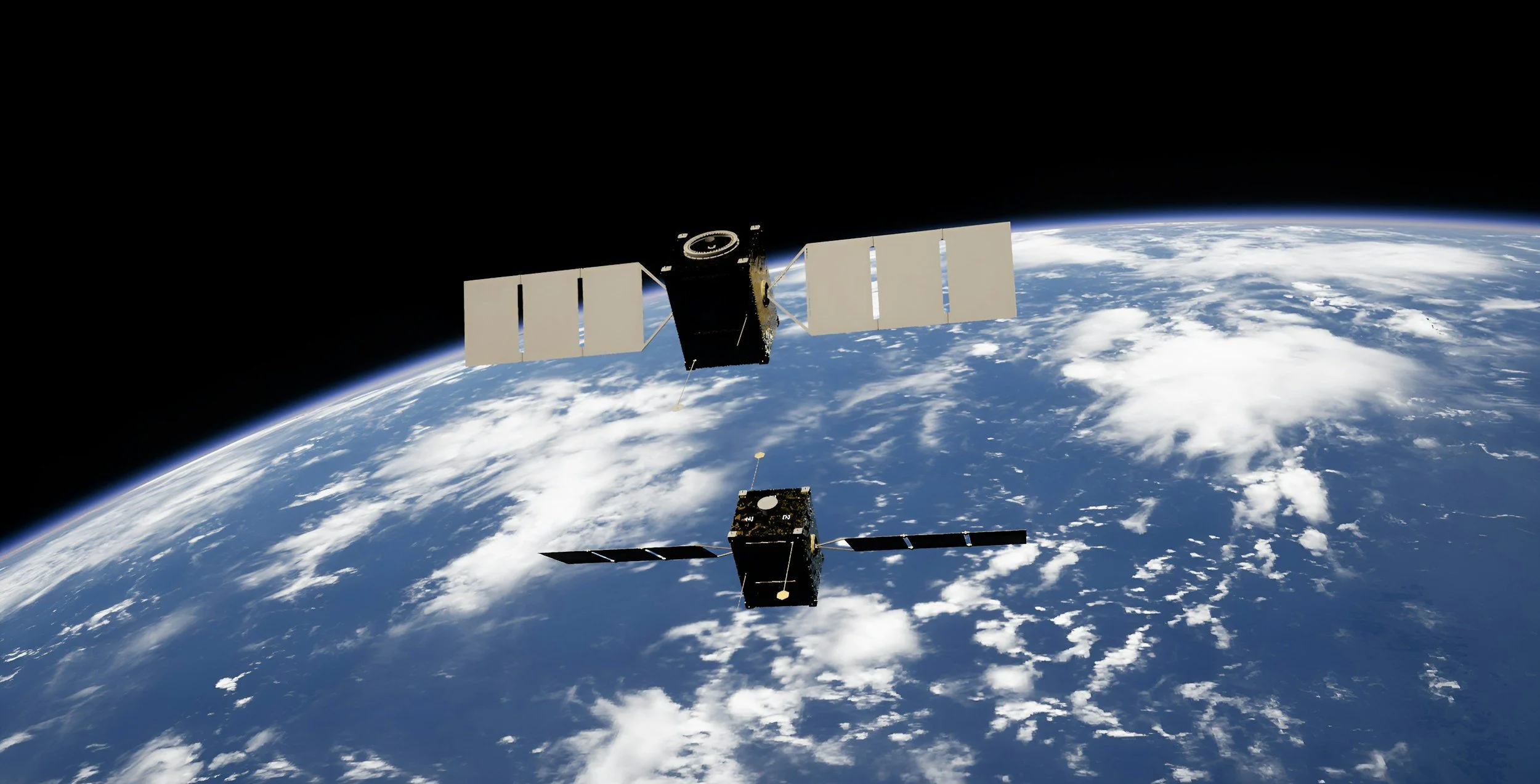

The space environment is getting more complex while public tools fall behind.

We deliver the clarity operators need, exactly when they need it.

Timing Advantages

1. Rapid growth in commercial satellites and constellations

More satellites mean more demand for environmental awareness, drag forecasting, radiation conditions, and transmission modeling.

2. Rising threats and uncertainty

Space-weather events, congested orbits, and geopolitical pressures increase operational risk and require better decision tools.

3. Declining public-sector tooling and increased private reliance

As federally maintained models age and budgets tighten, operators are turning to commercial solutions.

4. First-mover advantage

With fewer new government-backed tools being developed, a nimble startup can enter the market now and establish itself before competition grows.

What this means: This is a rare moment where demand is rising, competition is becoming increasingly limited, and operators are urgently looking for reliable, easy-to-use solutions.

Funding Trends

According to the National Science Board, as of 2023 business funding accounts for about 78% of all U.S. R&D performance, while the federal share has steadily decreased. Public funding for basic research no longer grows at the same rate as private-sector and applied R&D.

This shift places more responsibility on commercial innovators to fill critical gaps in modeling, tools, and operational analysis—especially in space weather, atmospheric research, and satellite operations.

What this means: Reduced federal R&D investment creates space for agile companies to innovate faster, respond to customer needs, and deliver solutions that traditional government-funded systems can’t.

Unmet Needs

Many existing atmospheric and space-weather tools provide raw data without context, assuming the user has specialized knowledge to interpret it. Operators must often stitch together multiple datasets and models, slowing down decisions and increasing mission risk.

Other gaps include:

Limited availability of user-friendly, integrated modeling tools.

Under-maintained legacy systems due to budget constraints.

Lack of real-time contextual analysis (e.g., “Is this environment severe or nominal?”).

Increasing operator demand for automation, simplicity, and actionable insights—not just plots.

What this means: Users across commercial, civil, and defense sectors need intuitive, modern tools that translate complex science into clear operational guidance.

Growing Industry

The global space economy reached $570 billion in 2023, growing 7.4% over the previous year. Commercial satellite services, Earth-observation platforms, and growing launch cadence continue to expand the operational footprint in space. Government space investment reached approximately $135 billion in 2024, with more than half allocated to defense and strategic programs.

Demand for reliable, real-time environmental modeling—including atmospheric transmission, space-weather monitoring, and orbital risk analysis—continues to rise as satellites proliferate and operational environments become more complex.

What this means: The expansion of the space economy, combined with rising operational risk in orbit, makes accurate, accessible space-environment tools more essential than ever.